What are retention costs in the customer lifetime value calculation?

Retention costs are the marketing costs (or marketing investments) that are designed to increase customer loyalty (or decrease switching). The intention is to increase the length of time that a consumer remains a customer of the firm or brand. In theory, the longer a firm or brand can retain customers, the more profitable they become (as revenue X time/years).

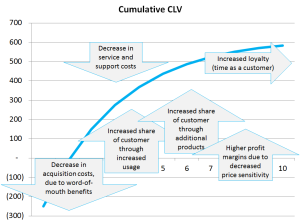

There is generally a positive correlation between the length of time a consumer has been a customer of a firm or brand and the revenue generated from the customer. In other words, over time, consumers tend to increase purchases with the companies or brands that they already have dealings with or make purchases from. This is discussed in a separate article on this website – increase in customer profitability over time. This is highlighted in the following diagram.

Please note that an increased in per customer revenue happens both naturally – that is, the consumer feels more comfortable and confident with the brand/firm – and it also happens through proactive marketing campaigns designed to cross sell the customer additional products. This is usually known as increasing “share of customer”.

As a result of increasing customer loyalty – the lifetime period of a customer – many firms and brands will invest heavily in retention strategies and tactics. Some of those are positive and give the consumer a rational or emotional reason to remain loyal – and some of those are negative, commonly known as a switching barrier, which makes it difficult or costly for the consumer to switch.

Firms invest quite heavily in retention and cross selling marketing activities. These activities are probably promotional but can extend across the full range of a marketing mix. All these activities, as retention or loyalty costs, are targeted at existing customers.

This is an important distinction to understand. Acquisition costs of those marketing costs targeted at non-customers in an attempt to win their business retention costs are those marketing investments targeted at existing customers. They may even attempt to reacquire lapsed/lost customers.

It is common in large companies to develop marketing programs for customer acquisition (winning new customers) and have marketing programs as well as for customer retention and up-selling.

In order to effectively and accurately calculate customer lifetime value, the firm needs to identify its range of retention/up-selling costs. One common relationship tactic is to use some form of loyalty card or frequent buyer program. But retention tactics extend far beyond just a loyalty program and also include: new products and services, newsletters, sales calls, hospitality, special events, discounts for existing customers, and so on. All these factors need to be taking into account when determining the average retention cost per customer.