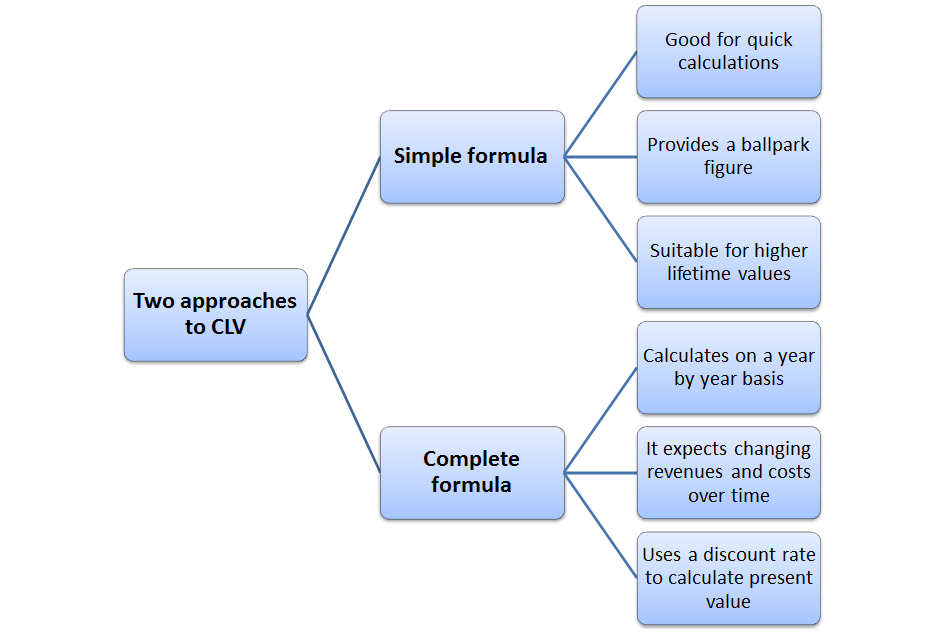

There are two main approaches to the customer lifetime value formula.

The Simple CLV Formula

The first is quite simple and it assumes that customer revenues and costs (per customer profit contribution) remain constant over the total time of the customer relationship. On this website, this approach has been referred to as the simple CLV formula.

The first customer lifetime value formula is very simple calculation to perform and can be done quite quickly, usually as a mental calculation – so it is worth knowing as a quick ready reckoner. And if there is little change in the firm’s share-of-customer of the lifetime of the customer, this basic formula is actually quite accurate.

Please see the article on the Simple Customer Lifetime Value Formula.

This formula is also used for the quick online CLV calculator.

The Full CLV Formula

The second formula involves calculating the net cash flow (that is, both revenue and costs associated with the customer) each year and is generally recognized as the accepted/formal approach to calculating customer lifetime value. Regardless, both formulas are of value and have been discussed on this website – please refer to Related Topics below.

The second calculation is little bit more complex, but please note that there is a free Excel template to calculate customer lifetime value available

Related topics

The full customer lifetime value formula

Example of a customer lifetime value calculation

When to use the simple customer lifetime value formula

Advantages and limitations of the simple customer lifetime value formula

Word-of-mouth in the CLV calculation