One of the key goals of measuring customer lifetime value is to track the average value over time and to look for positive and cost-effective increases. A key component in increasing customer lifetime value is to increase customer revenues through gaining increase in “share of customer”.

An increase share of customer will happen naturally over time as the consumer becomes more comfortable with a brand/firm and looks to extend their purchases with a brand/firm that they know and trust. Marketers will also try to deliberately increase revenue from existing customers through various marketing tactics and offers.

There are two broad ways to achieve this increase share of customer (but a total of seven pathways to growing customer revenues). The first is to sell a greater quantity of products to the consumer. If we use McDonald’s as an example, they could increase customer revenue if the average customer also bought coffee at McDonald’s once a week in addition to their weekly visit for a burger. In this case, they have effectively increased customer revenue through the sale of more products.

This is a common tactic in the banking sector, where the metric of products per customer is an important measure of the depth of the customer relationship.

The other approach to increasing share of customer is to increase the dollar value of what the customer purchases. In the airline industry as an example, if they could persuade more people to fly business class instead of the economy, then they have increased their revenue per customer without increasing the customer’s quantity of purchases.

Increasing customer profitability over time with CLV

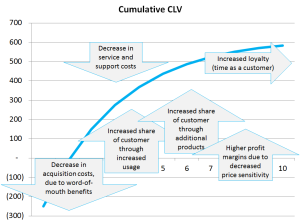

Reichheld’s studies, in the 1990s, identified through analysis of several industries that it is common for customer profitability to increase over time. Therefore, it is generally inappropriate to have a flat customer profit per year the year included in your customer lifetime value model.

Please note that the free customer lifetime value Excel template allows you to enter increasing consumer revenues, and dynamic consumer costs over a ten-year period.

As highlighted in the diagram, customer revenues will increase over time for the following reasons:

- Increased revenue (share-of-customer) = increased revenue

(This will occur through: increased product usage, purchasing of additional products, or purchasing of higher value products.)

- Reduced servicing costs = cost benefit

(Over time, customers become more educated in regards to the product/service and are less likely to need servicing support. Consider the difference between a new student at a university as compared to a student in their third year – the first student clearly needs more support and administrative time.)

- Increased word-of-mouth = reduces customer acquisition costs

(Longer term customers are more likely to become advocates and promote the brand to other consumers.)

- Decreased price sensitivity = increased revenue

(Over time, satisfied customers will be less likely to be concerned with price increases, resulting in higher contribution margins for these customers.)

- Increased retention/loyalty = longer revenue stream

(Obviously, the longer the customer relationship, the more years of revenue are delivered to the company.)