Defining Customer Equity

Customer equity is the sum of all customer lifetime values for a firm. In other words, we calculate each customer’s lifetime value and we total all of these values together to determine customer equity.

Customer equity, therefore, is the total expected profitability to be generated from a customer base over time.It is calculated using a compounding discount rate which allows us to consider the total expected profitability from our customer base in today’s dollars.

Should we include future customers in a customer equity calculation?

Existing customers are known to the organization – in that we know the current level of profit contribution, and we can estimate their retention/loyalty rate based upon our customer base history and analysis – which means that we can generally determine the customer lifetime value for each customer and then determine overall customer equity for the firm.

When we include customer is likely to be acquired in the future, we may have less information about them, but we can also make certain assumptions about their likely customer lifetime value based upon our existing customer base – which means that we have relatively reliable information to include future customers.

The reality is, that in today’s world of heavy social media usage, many businesses will gain new customers whether or not they engage in marketing-driven customer acquisition activities. This is because new customers will be attracted to the firm through referrals (both online and off-line), information they find online, then knowledge of the brand, independent research, and so on.

This means that, even if a firm stopped all their customer acquisition marketing activities, that they would continue to acquire new customers.

This is a strong case to always include future customers in the overall customer equity calculation, as the firm has earned these future customers due to their previous marketing activities and brand building efforts.

What is the customer equity formula?

Customer equity = sum of all customer lifetime values of the current and future customers

Note: as customer lifetime value should always be calculated using a discount rate, the above sum will provide the total expected profitability from current and future customers on a discounted basis as well.

An example of calculating customer equity

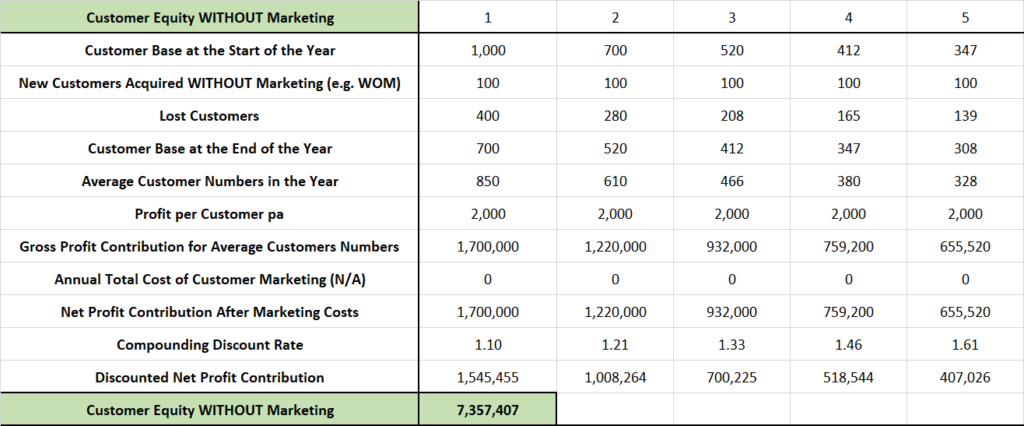

Assumptions for this example calculation

- We start with a customer base of 1,000 customers

- We “win” 100 new customers each year, even without customer acquisition actions

- The profit we make from the average customer is $2,000 per annum

- A 10% discount rate has been used

Note that we e are calculating customer equity assuming that the firm is NOT continuing to deliberately acquire news customers.

While this would not happen in practice, approaching the calculation in this manner is an effective way of measuring customer equity as it only takes into account marketing activities up until now.

Walk-through of the customer equity calculation

In this example, the retention rate is 60%, meaning that our churn rate is 40% – hence we lose 400 of 1,000 customers in the next year (year 1 of our calculation) and then 40% ongoing. However, this is slightly rectified due to our brand equity and we are likely to acquire 100 new customers each year, even without dedicated customer acquisition programs.

For this calculation, as we have a fluctuating number of customers each year, we can use the average number of customers in the year. In year 1 we start with 1,000 customers, but end the year with only 700 = 850 average customer base for the year.

Our 850 customers are then multiplied by the $2,000 pa per customer profit contribution, which equals $1,700,000 for the entire customer base. This figure is then discounted to 1,545,455 (to equate to a present day value).

We start the next year with 700 customers only (1,000 – 400 lost + 100 acquired) and we repeat the process with the same assumptions (but note that the discount rate compounds each year). This is continued ongoing (I use a 50 year horizon – please see this article on the rationale). And the sum of all the discounted profit contributions (e.g. 1,545,455 +1,008,264 + 700,225…) equals our total customer equity of $7,357,407.

Different customer equity calculations?

Please note that this website has an Excel template for calculating customer equity (available for free download), which calculates customer equity in three different ways.

- Customer equity of both current and future customers, assuming continued customer acquisition marketing efforts,

- Customer equity of both current and future customers, assuming no customer acquisition marketing efforts but some new customers from brand equity and related word-of-mouth, and

- Customer equity of the existing customer base only, with no future customers considered.

Depending upon your measurement purpose, each customer equity calculation method has some merit and value.

The first method is similar to measuring the overall value of a business as a going concern as it is likely that successful marketing activities will be continued.

The second method measures the impact and success of all marketing efforts up to now in creating value and customer profitability for the firm.

And the third method is more suitable for a small business (with limited brand equity) that is unlikely to acquire new customers without any marketing efforts.

Related Topics

The free Excel template for calculating customer equity

Why customer equity is a powerful metric

Free template for mapping the customer journey